Creating a budget for corporate fitness can be a daunting task, but it is a necessary step in providing employees with a wellness program that is both effective and sustainable. A well-designed fitness program can improve employee health, increase productivity, and reduce healthcare costs for the company. However, without a budget in place, it can be challenging to determine the resources needed to achieve these goals.

To create an effective budget for corporate fitness, you must first understand the needs of your employees. This includes identifying the types of fitness activities that will be most beneficial to them, as well as the incentives that will motivate them to participate. You must also consider the available resources, including facilities, equipment, and insurance, to ensure that your program is both feasible and cost-effective.

Once you have identified the needs of your employees and the resources available to you, you can begin planning your budget. This includes determining the cost of fitness activities, incentives, facilities, and insurance, as well as evaluating the value and benefits of your program. By continuously evaluating and adjusting your budget, you can ensure that your corporate fitness program remains effective and sustainable over time.

Key Takeaways

- To create an effective budget for corporate fitness, you must first understand the needs of your employees and the resources available to you.

- Planning your budget involves determining the cost of fitness activities, incentives, facilities, and insurance, as well as evaluating the value and benefits of your program.

- By continuously evaluating and adjusting your budget, you can ensure that your corporate fitness program remains effective and sustainable over time.

Identifying Needs

Popular posts:

When creating a budget for corporate fitness, it is important to first identify the needs of your employees and business. This will help you determine what type of fitness program to implement and how much budget to allocate for it. Here are two sub-sections that will help you identify your needs:

Assess Employee Needs and Interests

The first step in identifying your fitness needs is to assess the needs and interests of your employees. This can be done through surveys or focus groups. Ask your employees what type of fitness activities they would be interested in and what their fitness goals are. This will help you tailor your fitness program to meet the needs of your employees.

In addition to physical fitness, it is important to consider the mental health of your employees. Stress management is an important aspect of overall health and can be addressed through fitness programs such as yoga or meditation. Chronic diseases such as diabetes and heart disease can also be addressed through fitness programs, so it is important to consider the needs of employees with these conditions.

By assessing the needs and interests of your employees, you can create a fitness program that promotes job satisfaction, productivity, and morale.

Identify Your Business Needs

In addition to assessing the needs of your employees, it is important to identify the needs of your business. A fitness program can have a positive impact on the bottom line of your business by reducing absenteeism and increasing employee productivity.

Consider the type of work your employees do and how a fitness program can benefit their job performance. For example, if your employees sit at a desk for long periods of time, a fitness program that addresses posture and back health can be beneficial.

It is also important to consider the budget you have available for the fitness program. By identifying your business needs, you can create a fitness program that is both effective and within your budget.

Overall, by assessing the needs and interests of your employees and identifying your business needs, you can create a fitness program that promotes employee productivity, job satisfaction, and overall health.

Determine Available Resources

When creating a budget for your corporate fitness program, it is important to determine the resources that are available to you. This will help you create a budget that is realistic and effective. Consider factors such as available funding, staff time, and equipment.

Available Funding

The first step in determining your available resources is to identify how much funding is available for your fitness program. This can come from a variety of sources, such as your company’s budget, grants, or sponsorships. Once you have identified the amount of funding available, you can allocate it accordingly to different aspects of your program, such as equipment, staff, and incentives.

Staff Time

Another important resource to consider is staff time. Your fitness program will require staff to manage and implement it, such as fitness instructors, trainers, and wellness coordinators. Determine how much time your staff can dedicate to the program, and consider hiring additional staff if necessary. It is also important to ensure that your staff has the necessary training and certifications to effectively manage the program.

Equipment

Equipment is another important resource to consider when creating your budget. Determine what equipment is necessary for your program, such as fitness machines, weights, and exercise mats. Consider the quality and durability of the equipment, as well as maintenance and replacement costs. You may also consider leasing equipment to reduce upfront costs.

By considering these resources, you can create a budget that is tailored to your corporate fitness program’s needs. A well-designed program can lead to benefits such as increased productivity, reduced absenteeism, improved morale, and ultimately, a positive impact on your bottom line.

Consider the Cost of Fitness Activities

When creating a budget for your corporate fitness program, it’s important to consider the cost of fitness activities. Some activities may be more expensive than others, so it’s important to prioritize based on cost and employee interest.

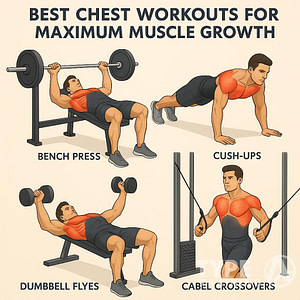

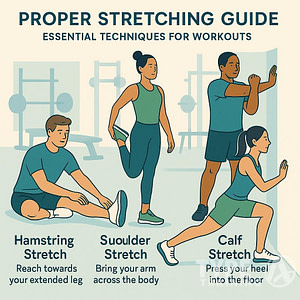

One way to save on costs is to offer fitness classes that do not require any equipment. Yoga, Pilates, and aerobics are all great examples of equipment-free classes that can be offered at a low cost. Additionally, offering virtual classes can also help reduce costs as they do not require a physical space or equipment.

If you do decide to offer equipment-based classes or activities, it’s important to consider the cost of purchasing and maintaining the equipment. Make sure to include these costs in your budget to avoid any surprises later on.

Another way to save on costs is to partner with local fitness studios or gyms. Many studios offer corporate discounts or packages that can help reduce costs. Additionally, partnering with a local gym can allow employees to access a wider range of equipment and classes at a lower cost than purchasing and maintaining equipment on your own.

Overall, when considering the cost of fitness activities, it’s important to prioritize based on cost and employee interest. By offering a variety of low-cost options and partnering with local fitness studios or gyms, you can create a budget that is realistic and effective for your corporate fitness program.

Consider the Cost of Incentives

If you plan to offer incentives for employee participation in your corporate fitness program, it’s important to consider the cost of these incentives when creating your budget.

Benefits-based incentives can be a great way to motivate employees to participate in your fitness program. These incentives can range from $200 to $800 per employee per year, depending on the type of program you offer. In addition to benefits-based incentives, you may also want to consider offering other types of incentives, such as biometric screenings and telephonic health coaching.

When creating your budget, it’s important to factor in the cost of these incentives. You’ll need to determine how much you can afford to spend on incentives while still staying within your overall budget. Keep in mind that the cost of incentives can add up quickly, so it’s important to be realistic about what you can afford.

One way to make the most of your budget is to offer incentives that are tied to specific goals or milestones. For example, you might offer a bonus to employees who reach a certain fitness level or who participate in a certain number of fitness classes. This can help to motivate employees while also keeping costs under control.

Another option is to offer incentives that are based on participation rather than results. For example, you might offer a small reward to employees who attend a certain number of fitness classes each month. This can help to encourage employees to participate in your program without breaking the bank.

Overall, when creating your budget for a corporate fitness program, it’s important to consider the cost of incentives. By offering benefits-based incentives and other types of incentives, you can help to motivate employees to participate in your program while also staying within your budget.

Consider the Cost of Facilities

When creating a budget for corporate fitness, it’s important to consider the cost of facilities. If you plan to use facilities outside of your workplace for fitness activities, you’ll need to factor in the cost of these facilities when creating your budget.

Some facilities may offer discounts for corporate groups, so it’s worth reaching out to them to inquire about any special rates. You may also be able to negotiate a lower rate based on the number of employees who will be using the facility.

If you plan to build an on-site fitness center, you’ll need to consider the cost of construction and equipment. This can be a significant expense, but it may be worth it in the long run if it encourages employees to be more active and leads to improved health outcomes.

Maintenance costs are another factor to consider when creating a budget for corporate fitness facilities. Regular maintenance is necessary to keep the equipment in good working order and ensure a safe environment for employees. You’ll also need to budget for repairs and replacements as needed.

Overall, it’s important to carefully consider the cost of facilities when creating a budget for corporate fitness. By doing so, you can ensure that you have the resources necessary to provide your employees with the tools they need to stay healthy and active.

Consider the Cost of Insurance

If your corporate fitness program involves physical activity, it’s important to consider the cost of insurance when creating your budget. Gym insurance is essential for your business and can protect you from costly lawsuits and damages. The cost of gym insurance can vary depending on several factors, including the size of your gym, the number of employees, and the services provided.

When selecting insurance for your corporate fitness program, it’s important to consider the following factors:

- Coverage: Make sure that your insurance policy covers all the activities and equipment used in your corporate fitness program. This can include weightlifting, cardio equipment, group fitness classes, and more.

- Liability: Liability insurance can protect your business from lawsuits and damages resulting from injuries or accidents that occur on your premises.

- Property: Property insurance can protect your business from damages to your equipment, furniture, and other property.

- Workers’ Compensation: If you have employees, you may be required to provide workers’ compensation insurance. This can protect your business from costly medical bills and lost wages if an employee is injured on the job.

When selecting an insurance policy, it’s important to carefully review the terms and conditions to ensure that you have adequate coverage. It’s also a good idea to compare rates from different insurance providers to find the best deal.

By considering the cost of insurance when creating your budget, you can ensure that your corporate fitness program is financially sustainable and protected from potential risks.

Planning the Budget

When it comes to creating a budget for your corporate fitness center, there are two main factors to consider: costs and revenue streams. By taking a closer look at these factors, you can create a budget that is both realistic and effective in achieving your fitness center’s goals.

Cost Considerations

The first step in planning your budget is to consider all of the costs associated with running your fitness center. This includes everything from facility expenses to personal training costs to the cost of fitness equipment. Some of the most common expenses to consider include:

- Facility expenses: This includes rent, utilities, cleaning, and maintenance costs for your fitness center.

- Personal training costs: If you offer personal training services at your fitness center, you’ll need to factor in the cost of paying your trainers.

- Fitness equipment: Purchasing and maintaining fitness equipment can be a significant expense for any fitness center.

- Gym memberships: If you offer gym memberships to your employees or clients, you’ll need to factor in the cost of providing these memberships.

By taking a closer look at these costs, you can create a basic budget that outlines your expected expenses for the year.

Revenue Streams

Once you have a clear understanding of your expected expenses, the next step is to consider your revenue streams. This includes all of the income your fitness center generates, such as membership fees, personal training fees, and revenue from any additional services you offer.

To create an effective budget, it’s important to have a clear understanding of your expected revenue streams. This will help you determine whether your fitness center is generating enough income to cover your expenses and generate a net income.

By taking a closer look at both your costs and revenue streams, you can create a budget that is both realistic and effective in achieving your fitness center’s goals. With the right budget in place, you can ensure that your fitness center is operating at its full potential while also generating a healthy net income.

Evaluating the Value and Benefits

When creating a budget for a corporate fitness program, it’s important to evaluate the value and benefits to both the employer and the employees. Here are some sub-sections to consider:

Return on Investment

One of the most important factors to consider when creating a budget for a corporate fitness program is the return on investment (ROI). It’s important to calculate the ROI to determine if the program is worth the investment. To calculate the ROI, you’ll need to compare the cost of the program to the benefits it provides. This can include factors such as reduced healthcare costs, increased productivity, and improved morale. By calculating the ROI, you can determine if the program is a worthwhile investment.

Employee Benefits

Corporate fitness programs can provide many benefits to employees. By offering a fitness program, employees can improve their health and wellness, which can lead to reduced healthcare costs and improved job satisfaction. Fitness programs can also help employees build a sense of community and engagement with their coworkers. By offering a fitness program, employers can show their employees that they care about their health and well-being.

Employer Benefits

In addition to the benefits to employees, corporate fitness programs can also provide many benefits to employers. By offering a fitness program, employers can improve the health and wellness of their employees, which can lead to increased productivity and reduced absenteeism. Fitness programs can also help employers attract and retain top talent. By offering a fitness program, employers can show that they care about the health and well-being of their employees, which can improve morale and job satisfaction.

Overall, creating a budget for a corporate fitness program requires careful evaluation of the value and benefits to both the employer and the employees. By calculating the ROI and considering the benefits to both parties, you can create a budget that provides the most value for your organization.

Continuously Evaluate and Adjust

Creating a budget for your corporate fitness program is an ongoing process. As your program evolves and your employees’ needs change, it’s important to continuously evaluate and adjust your budget accordingly. Here are some key factors to consider when evaluating and adjusting your budget:

Program Metrics

One of the most important factors to consider when evaluating your budget is your program metrics. Keep track of key performance indicators (KPIs) such as employee participation rates, program engagement, and program satisfaction. Use this data to identify areas where you may need to adjust your budget to better meet the needs of your employees. For example, if you notice that participation rates are low for a particular program, you may need to allocate more resources to promote that program to your employees.

Employee Feedback

Employee feedback is another important factor to consider when evaluating your budget. Solicit feedback from your employees on a regular basis to understand their needs and preferences. Use this feedback to adjust your budget to better meet the needs of your employees. For example, if your employees are requesting more yoga classes, you may need to allocate more resources to your yoga program.

Available Resources

Finally, it’s important to consider your available resources when evaluating and adjusting your budget. Take a realistic look at your financial resources, staff, and other available resources to determine what changes you can make to your program. For example, if you have limited financial resources, you may need to focus on low-cost or no-cost programs to meet the needs of your employees.

By continuously evaluating and adjusting your budget based on program metrics, employee feedback, and available resources, you can ensure that your corporate fitness program remains effective and meets the needs of your employees.

Conclusion

Creating a budget for your corporate fitness program is a crucial step in ensuring its success. By taking into account various factors such as available resources, the cost of fitness activities and incentives, and staff time, you can create a budget that is both realistic and effective.

To create a budget for your corporate fitness program, consider the following 15 steps:

- Develop a business plan for your program that outlines your goals, target customers, and services offered.

- Evaluate your work environment to determine what fitness activities are feasible and appropriate.

- Survey your employees to determine their fitness interests and needs.

- Determine the level of service you want to provide, such as group fitness classes, personal training, or wellness coaching.

- Research the cost of fitness activities and incentives, such as gym memberships, fitness equipment, and wellness programs.

- Consider the cost of hiring a fitness manager or department to oversee your program.

- Determine the budget for marketing and promoting your program to your employees.

- Consider the cost of any necessary equipment, such as fitness trackers or heart rate monitors.

- Determine the cost of any necessary training or certification for your fitness staff.

- Consider the cost of any necessary insurance or liability coverage.

- Determine the cost of any necessary permits or licenses.

- Consider the cost of any necessary software or technology to manage your program.

- Determine the cost of any necessary maintenance or repairs for your fitness equipment.

- Consider the cost of any necessary upgrades or renovations to your fitness facilities.

- Determine the cost of any necessary ongoing support or maintenance for your program.

By following these steps, you can create a budget that is both comprehensive and effective for your corporate fitness program. Remember to continually evaluate and adjust your budget as needed to ensure the ongoing success of your program.

Frequently Asked Questions

What are some key components to consider when creating a budget for a corporate fitness program?

When creating a budget for a corporate fitness program, it is important to consider various key components such as the number of employees participating, the type of fitness activities offered, the frequency of classes, and the equipment and facilities required. You should also consider the cost of hiring fitness instructors and trainers, as well as the cost of marketing and promoting the program.

How can I determine the appropriate budget for a corporate fitness program?

To determine the appropriate budget for a corporate fitness program, you should first consider the goals and objectives of the program. Once you have established these goals, you can then determine the number of employees who will be participating and the types of fitness activities that will be offered. You should also consider the cost of equipment and facilities, as well as the cost of hiring instructors and trainers. It is important to allocate sufficient funds for marketing and promoting the program to ensure maximum participation.

What are some common expenses associated with corporate fitness programs?

Some common expenses associated with corporate fitness programs include the cost of equipment and facilities, the cost of hiring fitness instructors and trainers, marketing and promotional expenses, and administrative costs. Other expenses may include the cost of insurance and liability coverage, as well as the cost of maintaining and repairing equipment.

How can I ensure that my corporate fitness program stays within budget?

To ensure that your corporate fitness program stays within budget, it is important to establish a clear budget at the outset and to monitor expenses closely throughout the program. You should also consider implementing cost-saving measures such as negotiating lower prices for equipment and facilities, and exploring alternative marketing and promotional strategies. Regularly reviewing and adjusting the budget as needed can also help to ensure that the program stays within budget.

What are some ways to maximize the impact of a corporate fitness program while staying within budget?

To maximize the impact of a corporate fitness program while staying within budget, you should consider offering a variety of fitness activities that appeal to a wide range of employees. You should also consider incorporating wellness and nutrition programs into the overall program to promote a holistic approach to health and wellness. Additionally, you can explore alternative marketing and promotional strategies such as social media and email marketing to reach a wider audience at a lower cost.

Are there any cost-saving measures that can be taken when creating a budget for a corporate fitness program?

Yes, there are several cost-saving measures that can be taken when creating a budget for a corporate fitness program. These include negotiating lower prices for equipment and facilities, exploring alternative marketing and promotional strategies, and implementing wellness and nutrition programs to promote overall health and wellness. You can also consider partnering with other companies or organizations to share the cost of equipment and facilities, or offering incentives for employees who participate in the program.